Charles Schwab is in talks to buy TD Ameritrade, a source told CNBC's Becky Quick on Thursday. A deal could be announced as early as Thursday.

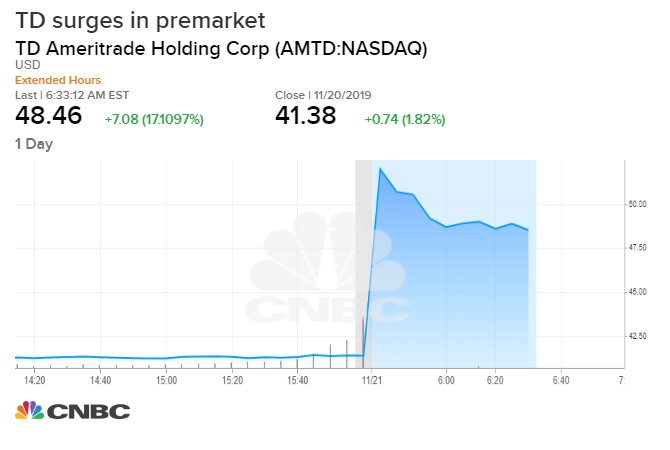

Shares of TD Ameritrade soared more than 20% in premarket trading on the report. Schwab's shares rose 7%.

A deal between Schwab and TD Ameritrade would consolidate an industry going through massive disruption. In recent months, all of the major brokerages have announced plans to go to zero commissions.

Schwab was the first of the major players to make the move, eliminating commissions in early October. Schwab's competitors, including Fidelity and TD Ameritrade, were quick to follow.

Calls to Schwab and TD Ameritrade weren't immediately returned.

Schwab's founder and chairman Charles Schwab told CNBC's Bob Pisani last month that consolidation in the retail brokerage industry is a "logical conclusion that will occur."

"Certainty at the right valuation, we would do it, but we are really strong and very independent the way we do things and so if its happens that its appropriate for our shareholders we will do it," Schwab said in response to if Schwab is a possible buyer of another broker.

Not charging for trades is a boon for consumers, but it's left the brokerages scrambling to find ways to maintain profits. A deal between Schwab and TD Ameritrade would create a behemoth with $5 trillion in combined assets.

Major brokerage firms have been pressured to go to zero fees since 2013 when Silicon Valley start-up Robinhood offered stock trading for free. Since then, Vanguard Group slashed fees on exchange-traded funds trades and J.P. Morgan Chase started its own free trading app. Interactive Brokers also announced a commission-free product called IBKR Lite. Other players include ETrade Financial.

After dropping commissions, Schwab's stock was under pressure as investors worried that the lost commission revenue, which fed about $90 million to $100 million in quarterly revenue, would pressure margins. However, the stock has recovered, bolstered by strong earnings last month that showed client assets reached a record high in the third quarter. Last week, Schwab showed that the free trading is paying off in terms of new client accounts. The broker said it added 142,000 new brokerage accounts in October, 31% more than the number of new clients added in September and a 7% jump from October of last year. The new accounts brought Schwab's client assets to a record $3.85 trillion.

Schwab and TD Ameritrade are the two biggest publicly traded discount brokers. Schwab has a market capitalization of $57.5 billion, and Ameritrade has a $22.4 billion market cap,

Shares of discount brokers rose on hopes for further consolidation in the sector, with Interactive Brokers up 3.3% and E-Trade surging 6.8%.

—CNBC's Becky Quick and Terri Cullen contributed to this report.

https://www.cnbc.com/2019/11/21/charles-schwab-in-talks-to-buy-td-ameritrade-a-deal-could-be-announced-as-early-as-today-source-says.html

2019-11-21 10:38:00Z

CAIiEONtoye3S2h0xX0ib5yqza4qGQgEKhAIACoHCAow2Nb3CjDivdcCMJ_5ngY

Tidak ada komentar:

Posting Komentar